Environmental Protection Agency reporting measures and market mechanisms like the U.S. Green Building Council LEED rating system could position publicly traded portland cement, concrete and aggregate producers for seamless compliance with a proposed U.S. Securities and Exchange Commission rule on greenhouse gas (GHG) emissions and global warming risk disclosures.

The subject of a public comment period closing this month, the rule stands to apply to such New York Stock Exchange-traded entities as Arcosa Inc., Eagle Materials, MDU Resources, Martin Marietta Materials, Summit Materials and Vulcan Materials—all U.S. based. They and other companies registering with the SEC would have to include in official statements a) climate-related risks that are reasonably likely to have a material impact on their business, results of operations, or financial condition; b) certain climate-related financial statement metrics in a note to their audited financial statements; and, c) GHG emissions, which have become a commonly used metric to assess a registrant’s exposure to such risks.

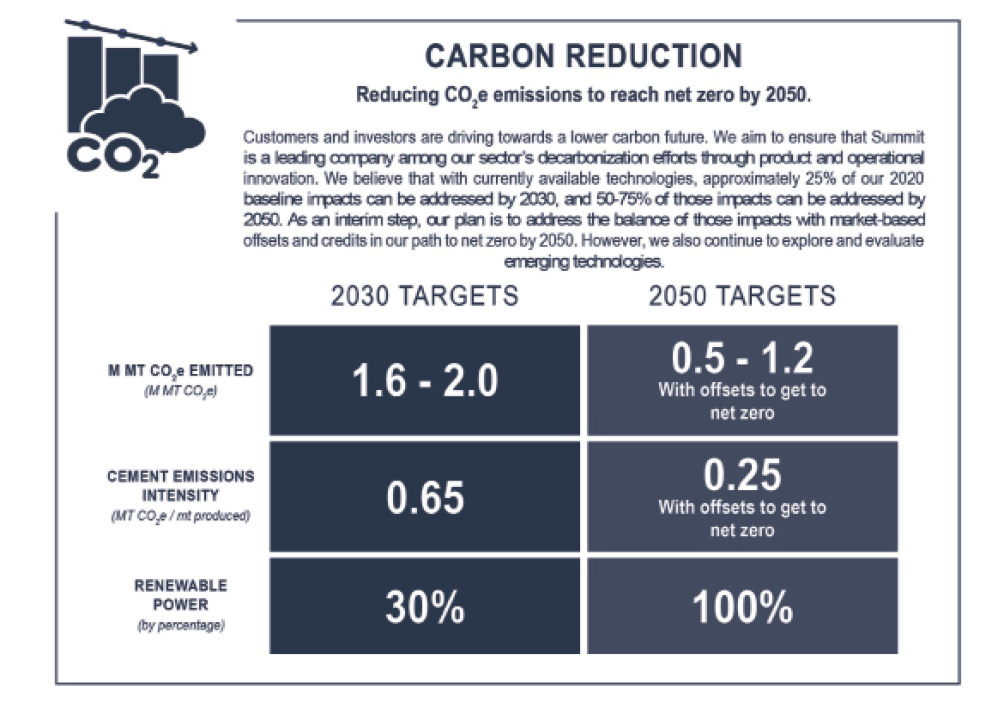

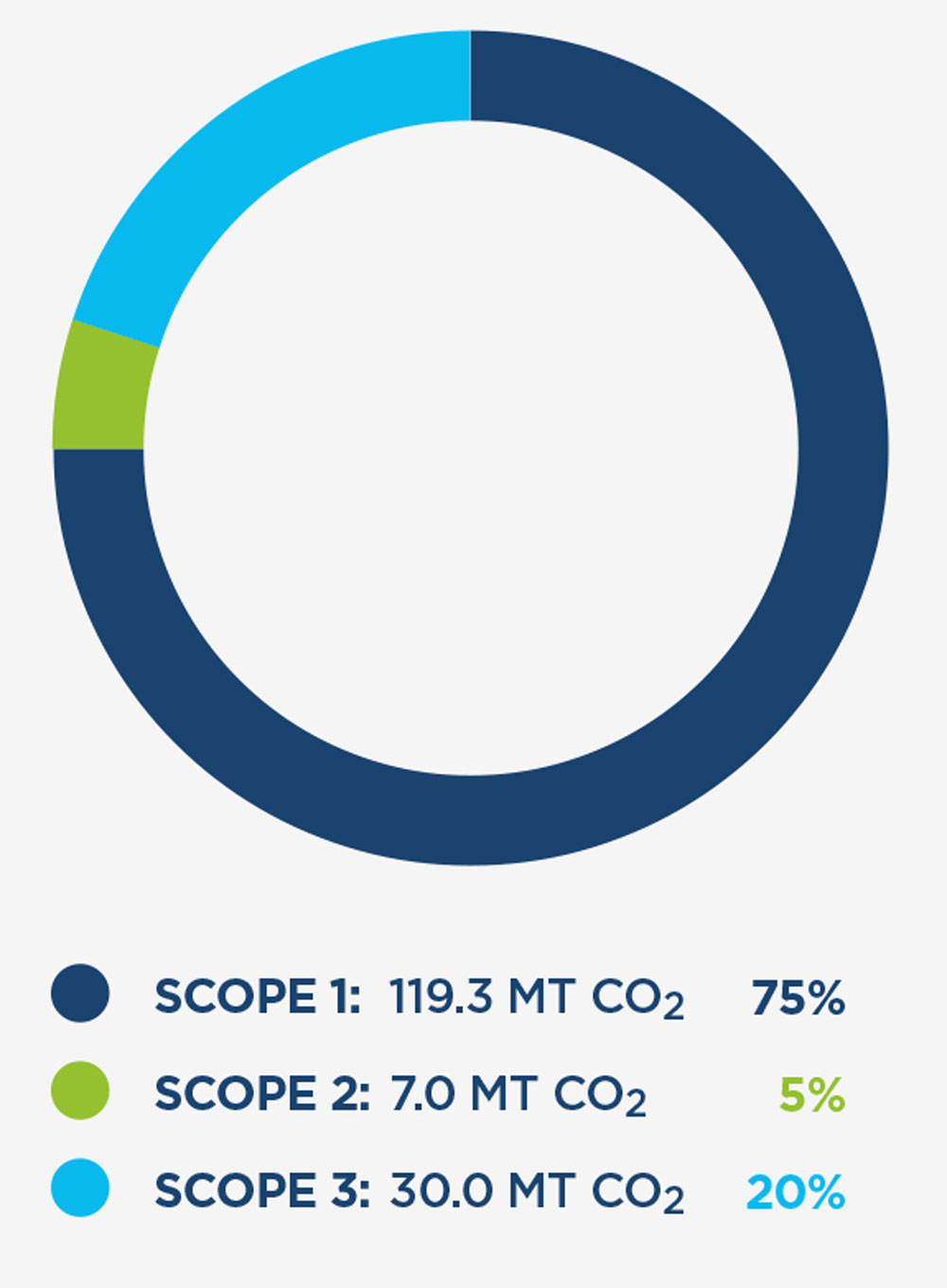

Cement producers are keen to the latter, based on EPA reporting of carbon dioxide and other GHG emissions associated with kiln calcining and clinkering phases. Cement and concrete producers that have prepared Environmental Product Declarations (EPD) for customers seeking LEED certification or otherwise mindful of embodied carbon will see parallels between EPD data points and the SEC proposed rule. In a manner similar to a declaration auditor, the agency would require a public company to disclose direct greenhouse gas emissions (Scope 1) information; indirect emissions from purchased electricity or other forms of energy (Scope 2); and, potentially, GHG emissions from upstream and downstream activities in its value chain (Scope 3).

If adopted, the proposed rule “would provide investors with consistent, comparable, and decision-useful information, and clear reporting obligations for [stock] issuers,” contends SEC Chair Gary Gensler. “Investors representing literally tens of trillions of dollars support climate-related disclosures because they recognize that climate risks can pose significant financial risks to companies. [Our] proposal would help issuers more efficiently and effectively disclose these risks and meet investor demand, as many issuers already seek to do. Companies and investors alike would benefit from the clear rules of the road proposed in this release. I believe the SEC has a role to play when there’s this level of demand for consistent and comparable information that may affect financial performance.”